Your teenager’s comprehension of how or why she should understand the value of money is a LEARNED skill and for many people does not come naturally. You may have made her sit through carefully thought-out lectures in a futile attempt to educate her on the importance of saving and spending. The problem is that lectures don’t work, neither does arguing or yelling.

Money can tell you about your teen, not only how he will handle his money as an adult, but how he will manage his life in general. Teen’s live in the now – tomorrow may never come.. They overspend. They buy things impulsively rather than deliberately. They often borrow from friends and family and can never pay them back. Many times these teens have an indulgent, conflict avoidant, or maybe uninformed parent who is the true source of their problem. If parent;s would stick to the limit, many of their teen’s overspending problems would take care of themselves. There are things you can do to educate your teen about money.

Talk to your teen about money

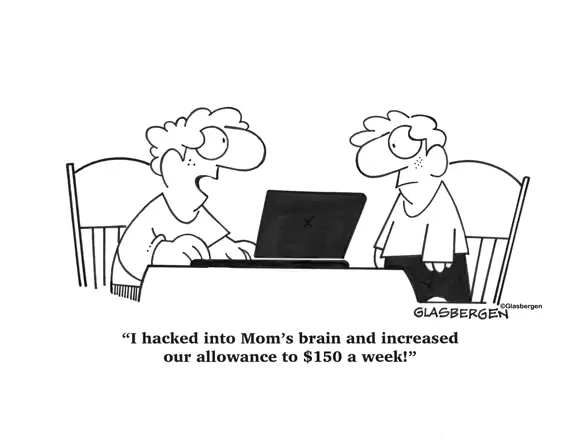

Most teens don’t have a good understanding of what things cost, or about saving, or about value – that’s why advertisers target the teen market so heavily – so much discretionary income, so little judgement. Until you tell her differently your teen is liable to be extremely unrealistic about money. Give her some realities,talk about what you spend your money on and how you have to say “no” to yourself sometimes so that you can meet goals for the future. Teach her there is no such thing as free money.

Decide how the teen gets money – Your teen’s allowance needs to be more than fun money. It should be large enough, if possible, that he can pay for things that matter in real life, such as clothing, toiletries, social events and entertainment as examples. You need to establish a budget with him. Let him know you will take on certain things for him and that he is responsible for certain things. Budgets are where your teen cn truly experience the reality of fiscal responsibility, which can pay large dividends later in life

Hold the line – Many parents don’t require their teens stick to the budget and give in and make exceptions because they feel guilty or sorry for their teen, or don’t want to make them angry. Don’t get stuck into the trap of lending money against the next allowance. Tell them “You’ll have to do what I do when I overspend, which is live on less for a couple more weeks. They need to learn the experience of learning that you spend what you have, not what you will have.

Set up a savings account for your teen – Not only do you want your teen to buy wisely, you also want him to develop a habit of saving money.. Take him to the bank and help him set up an account. You want him to develop the habit of putting a little away every time he gets some money, whether it’s his allowance or a gift.

IF YOUR TEEN OVERSPENDS DON’T RUSH TO THE RESCUE. ALLOW HIM TO EXPERIENCE THE NATURAL CONSEQUENCES OF OVERSPENDING

YOu have to work hard to get what you want in life. However, the only person learning that lesson is the one who is doing the work. If you want to get into your dream university, you have to work hard to get the grades. If you want to conquer the next level of your favorite video game, you have to work hard at developing your strategy. If you want to be on the varsity swim team, you have to work hard to prove your skill. If your child wants you to buy him expensive things, then he should work hard to demonstrate that he understands and appreciate the value of money.

If you are raising a teenager, that kid should be earning an allowance. Notice that I used the word earning and not receiving.

Helping your kid to understand how money works is a step-by-step process. The goal is NOT to make him keep track of the cost of every bite of cereal he eats or to get him to understand the weight you may feel on your shoulders from your home mortgage. These early lessons are about taking small steps towards gaining financial savvy… one lesson at a time. When it comes to understanding things like cash flow, savings, living beyond your means, debt, interest, etc. then there is no greater lesson than feeling the effects of his poorly thought out financial choices.

By letting him save his own money in order to go to the movies, he is being exposed to the basic idea that working hard and saving for something he wants is worth the effort. Stashing away some money each week for a $300 iPhone is not a baby step and may seem unattainable at first. Giving your kid the opportunity to save money to go to a $15 movie is more within his reach and helps to set him up for success in the long run. Soon he will use these tools to know how to save for larger, more meaningful things.

Whatever amount you decide on for allowance, it should be just enough that he can actually utilize it, but it will also take some careful planning on his part. It’s important that he is able to earn enough to use each week but also need to save some of it for future use. For example, a great financial lesson at thirteen is,

Should I spend the rest of this week’s allowance on going to the movies with friends, or save that money so I have enough to go to Universal Studios next weekend? I can’t do both.